are union dues tax deductible in 2020

The workshops are designed for new Local Treasurers as well as experienced treasurers who want a refresher. Consult your tax advisor to confirm.

Lodging Your Tax Return Made Easy

Furthermore you cannot claim a tax deduction.

. This is a result of the tax reform bill signed into law on December 22 2017. Line 21200 was line 212 before tax year 2019. Federal law allows unions and employers to enter.

Miscellaneous itemized deductions are those deductions that would have. Annual dues for membership in a trade union or an association of public servants. Tax reform eliminated the deduction for union dues for tax years 2018-2025.

Union Dues or Professional Membership Dues You Cannot Claim. Professional board dues required under provincial or territorial law. To enter your union dues for work performed as an employee W-2.

Union dues may be tax deductible subject to certain limitations. Educator expense tax deduction renewed for 2020 tax returns. Claiming union dues twice can result in a notice of reassessment and a possible penalty tax and interest owing.

Union dues may be deductible from California income taxes if you qualify to itemize on your California tax return. If you are Married Filing Separately and your spouse itemizes deductions on their Minnesota return you must also itemize. If you are an employee you can claim your union dues as a job-related expense if you itemize deductions.

Claim the total of the following amounts that you paid or that were paid for you and reported as income in the year related to your employement. The amount of dues collected from employees represented by unions is subject to federal and state laws and court rulings. You cannot claim a tax deduction for initiation fees licences special assessments or charges not related to the operating cost of your company.

This publication explains that you can no longer claim any miscellaneous itemized deductions unless you fall into one of the qualified categories of employment claiming a deduction relating to unreimbursed employee expenses. The NLRA allows unions and employers to enter into union-security agreements which require the payment of dues or dues equivalents as a condition of employment. January 6 2020 3 Min Read.

However you can deduct contributions as taxes if state law requires you to make them to a state unemployment fund that covers you for the loss of wages from unemployment caused by business conditions. UNION DUES ARE NO LONGER TAX DEDUCTIBLE For tax years 2018 through 2025 union dues are no longer deductible on your federal income tax return even if itemized deductions are taken. Taxpayers are allowed to write off certain expenses they incur to maintain their jobs and claiming annual professional or union dues on your income tax return helps you to lower your taxable income and reduce your tax burden.

OEA Treasurer Mark Hill will facilitate the workshops. Union dues may be deductible from California income taxes if you qualify to itemize on your California tax. Learn about the Claim of Right deduction.

The chart below details Standard Dues Deductions Amounts for 2020 NEACTATALB dues. A 2020 Center for American Progress Action Fund brief stated This type of above-the-line deduction would allow union members to deduct the costs of earning their income and result in the tax code more accurately measuring individuals ability to pay Opposition to union dues deductions. 1 were not in fact entitled to the income and 2 have repaid the.

As a result of the Tax Cuts and Jobs Act TCJA that Congress passed and was signed into law on December 22 2017 employees can no longer deduct union dues from their federal income tax in years 2018-2025. Are Union Dues Tax Deductible 2020. Eligible educators can deduct up to 250 of qualified expenses you paid in 2020.

For tax years 2018 through 2025 union dues and all employee expenses are no longer deductible even if the employee can itemize deductions. SOLVED by TurboTax 7794 Updated December 22 2021. However if the taxpayer is self-employed and pays union dues those dues are deductible as a business expense.

If you and your spouse are filing jointly and. 31 2021 the City of New York and other employers deducted union dues for the UFT from those UFT members who were so designated. Beginning with tax year 2019 Minnesota provides for its own allowable itemized deductions.

Attendance at an OEA sanctioned Treasurers Workshop is a requirement for the OEA Fiscal Fitness Award. A reminder for tax season. If you are self-employed you can enter your union dues as a Schedule C business expense.

Other local officers are also welcome to attend. In tax years 2018 through 2025 union dues employee expenses and all taxable activity as a corporation will no longer qualify for deduction if either employee or corporation itemizes their deductions. Medical and dental expenses.

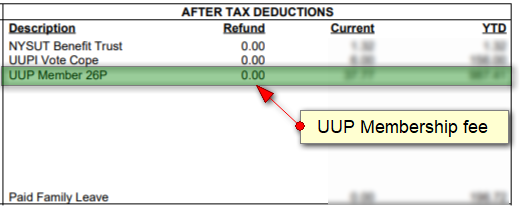

We have printed a chart you can use to compute the amount deducted on your behalf and remitted to the UFT. They along with other miscellaneous job-related expenses like tools were deductible to the extent that they exceeded 2 of your adjusted gross income AGI. During the year ending Dec.

Tax Deduction of Your TALB Dues. Are union dues tax deductible in California 2020. Tax reform changed the rules of union due deductions.

Its confusing because in prior years union dues and expenses were deductible on Schedule A. Due to tax reform union dues became due deductions instead of deductions. Thanks to union victories the educator expense tax deduction has been renewed for 2020 returns - and theres a state deduction for your union dues too.

However most employees can no longer deduct union dues on their federal tax return in tax years 2018 through 2025 as a result of the Tax Cuts and Jobs Act TCJA that Congress signed into law on December 22 2017. You cant deduct voluntary unemployment benefit fund contributions you make to a union fund or a private fund. Job-related expenses arent fully deductible as they are subject to the 2 rule.

Common Minnesota itemized deductions include. Can I Deduct Union Dues Now. If youre self-employed you can deduct union dues as a business expense.

Taxpayers who have paid Massachusetts personal income taxes in a prior year on income attributed to them under a claim of right may deduct such amounts of that income from their gross income if it is later determined that they.

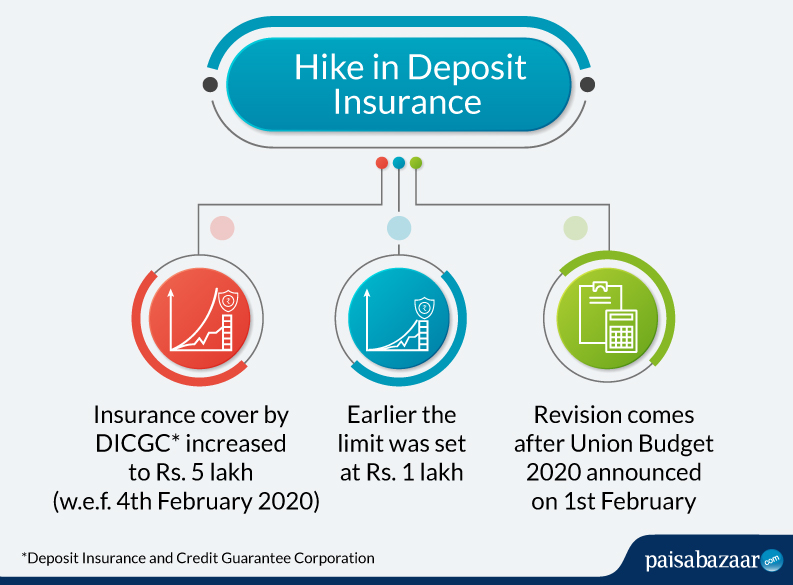

Dicgc Deposit Insurance Coverage Increased To Rs 5 Lakh I Paisabazaar

Purchase Your Tickets Today For The Chance To Win One Of The 5 Prizes Listed Below Tickets Cost You Can Buy 5 For Drawing Held Wedn Union County Raffle Waxhaw

Are Union Dues Tax Deductible Uk Ictsd Org

Are Union Dues Tax Deductible Uk Ictsd Org

Bill Seeks To Make Union Dues Tax Deductible Iam District 141

Deducting Union Dues Drake17 And Prior

Union Professional And Other Dues For Medical Residents Md Tax

Are Union Dues Tax Deductible Canada Cubetoronto Com

Give Me A Tax Break Union Dues Changes And More On The Horizon Barnes Thornburg

Deducting Union Dues On Nys Taxes Uup Buffalo Center

A Tax Break For Union Dues Wsj

Are Union Fees Tax Deductible Canada Ictsd Org

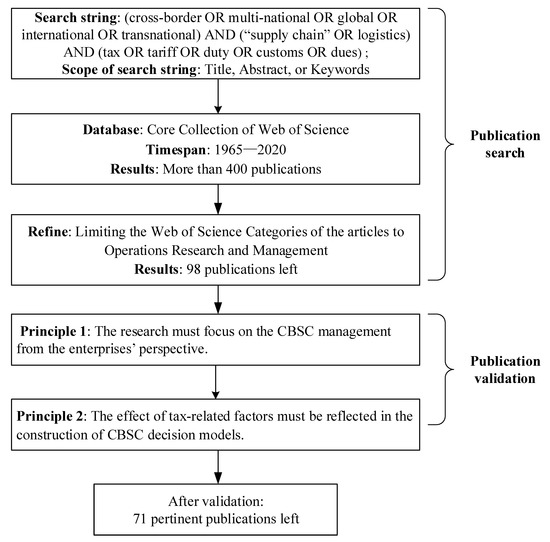

Jtaer Free Full Text A Literature Review Of Taxes In Cross Border Supply Chain Modeling Themes Tax Types And New Trade Offs Html

Tax Deduction For Union Dues Included In Budget Plan Ballotpedia News